Financial Planning in Born a Crime – Key Lessons

Introduction

Trevor Noah’s memoir, Born a Crime, tells the story of his childhood in apartheid and post-apartheid South Africa. The book highlights many themes, including racism, identity, and survival. A key but often overlooked theme is financial planning. Throughout the book, Noah and his mother, Patricia, use financial strategies to navigate poverty. Their approach to money showcases resilience, adaptability, and financial wisdom.

Understanding Financial Planning in Born a Crime

Financial planning involves budgeting, saving, investing, and managing money wisely. For Noah and his mother, financial planning was not just about wealth. It was about survival. They used different methods to stretch every rand, ensuring they had enough for necessities and emergencies.

The Role of Patricia Noah in Financial Planning

Patricia Noah was the driving force behind the family’s financial stability. She understood the importance of money and planned carefully.

Smart Spending

She avoided unnecessary expenses. Instead of luxury, she focused on essentials. She did not waste money on brands or status symbols. Instead, she invested in things that mattered, like her son’s education.

Saving for the Future

Even in difficult times, Patricia saved money. She believed in financial security. Her savings allowed them to escape tough situations, such as when she left an abusive marriage. Without her financial discipline, escaping hardship would have been much harder.

Hustling and Entrepreneurship

Trevor Noah learned about money through hustling. He used creative ways to earn, save, and invest.

Selling Pirated CDs

As a teenager, Trevor started a business selling pirated CDs. He bought cheap blank CDs, burned music onto them, and resold them for a profit. This venture taught him key financial lessons, including:

- Understanding supply and demand

- Managing costs and pricing

- Handling customers and marketing

The DJ Business

Trevor expanded his CD business into a DJing career. He provided music for parties and made money doing something he loved. He reinvested profits into equipment and grew his business. This demonstrated financial reinvestment and strategic planning.

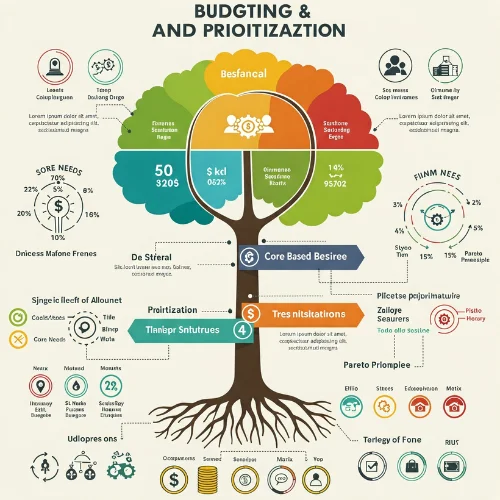

Budgeting and Prioritization

Even with limited resources, Trevor and his mother budgeted wisely.

Prioritizing Education

Patricia Noah saw education as an investment. Despite financial struggles, she ensured Trevor attended good schools. She worked multiple jobs to pay for his schooling. This financial decision changed his life.

Avoiding Debt

Unlike many, Patricia avoided unnecessary debt. She did not take loans for luxuries. She understood the dangers of borrowing money without a solid repayment plan.

Lessons from Born a Crime on Financial Planning

The book offers several financial lessons:

Importance of Multiple Income Streams

Trevor had multiple income sources. He sold CDs, did DJ gigs, and worked small jobs. This diversification protected him from financial failure.

The Value of Saving and Emergency Funds

Patricia always saved money for emergencies. This helped her leave an abusive husband and survive tough times.

Investing in Skills

Trevor used his skills to make money. Instead of waiting for opportunities, he created them. He learned how to hustle, market, and manage finances.

Frequently Asked Questions

What financial strategies did Trevor Noah use in Born a Crime?

Trevor used multiple income streams, saved money, and reinvested profits into his businesses. He also kept expenses low and adapted to financial challenges.

How did Patricia Noah influence Trevor’s financial habits?

Patricia taught Trevor the value of hard work, saving, and smart spending. She set an example by prioritizing education and avoiding debt.

What can readers learn about financial planning from the book?

The book teaches the importance of budgeting, saving, investing in skills, and maintaining multiple income sources. It also highlights the importance of financial independence, especially for women.

Conclusion

Financial planning played a crucial role in Born a Crime. Through careful budgeting, saving, and smart investments, Trevor and his mother navigated poverty. Their financial discipline helped them survive and succeed. The book serves as a reminder that financial planning is not just for the wealthy—it is for everyone. Whether through side hustles, savings, or education, wise financial choices can shape a better future.